Supreme Tips About R&d On Income Statement

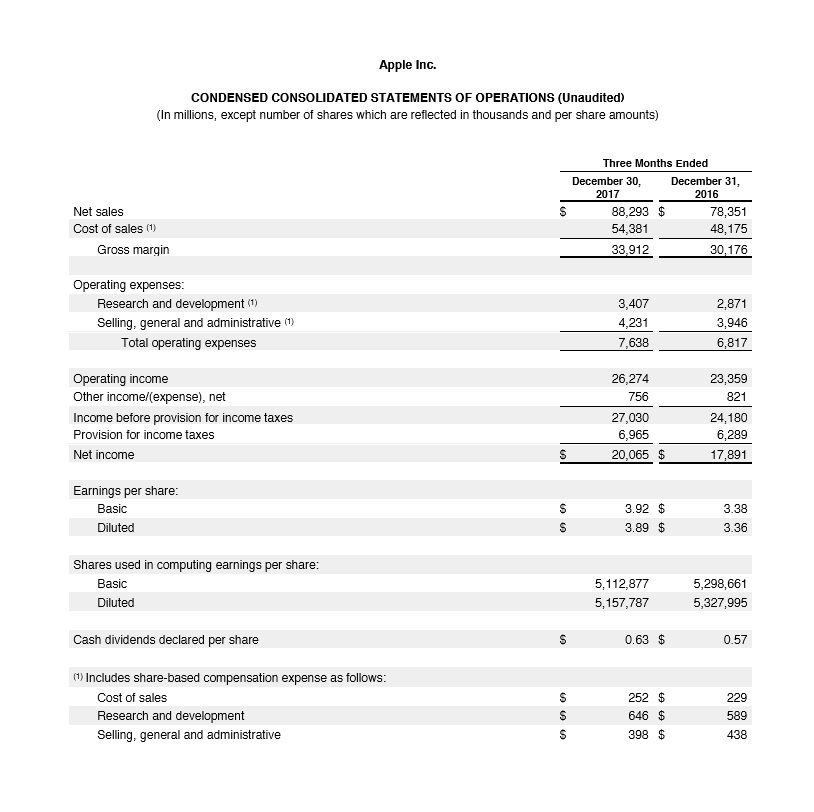

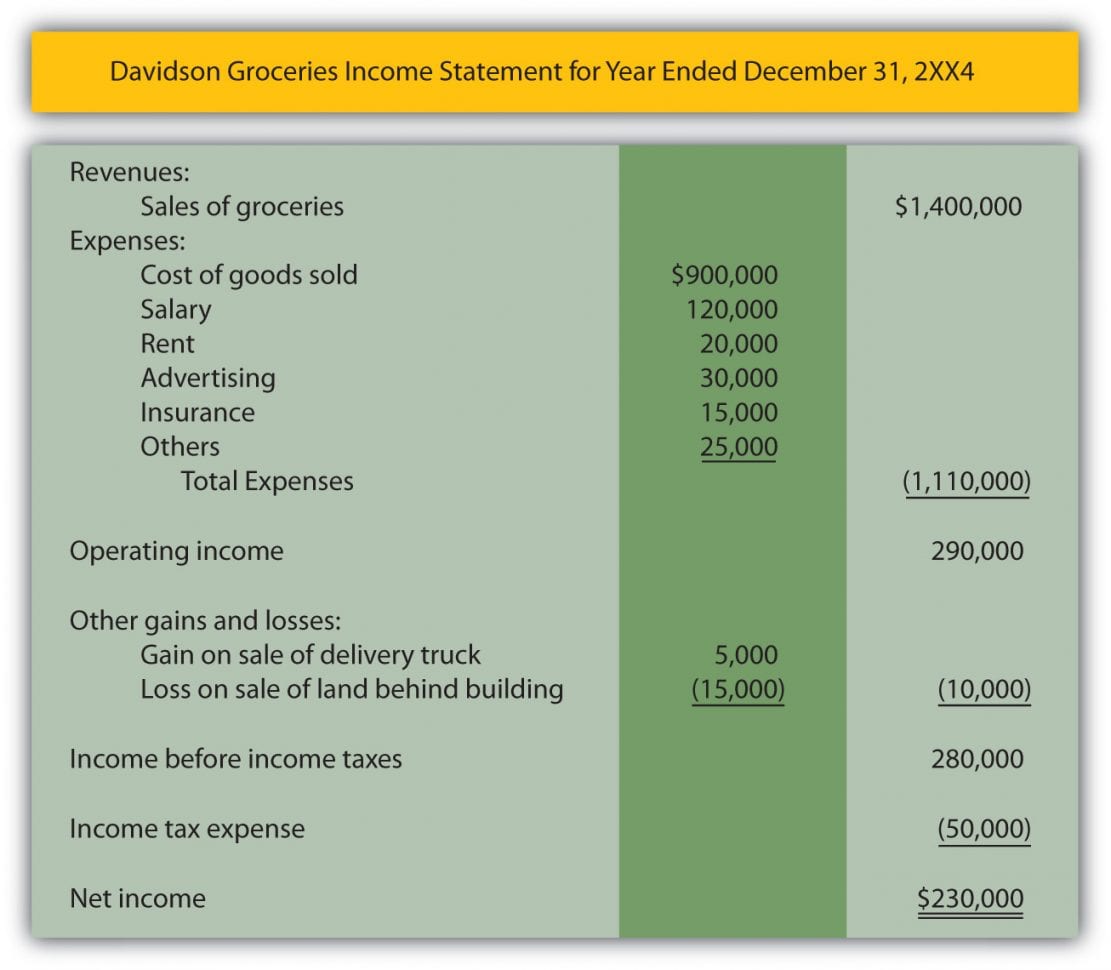

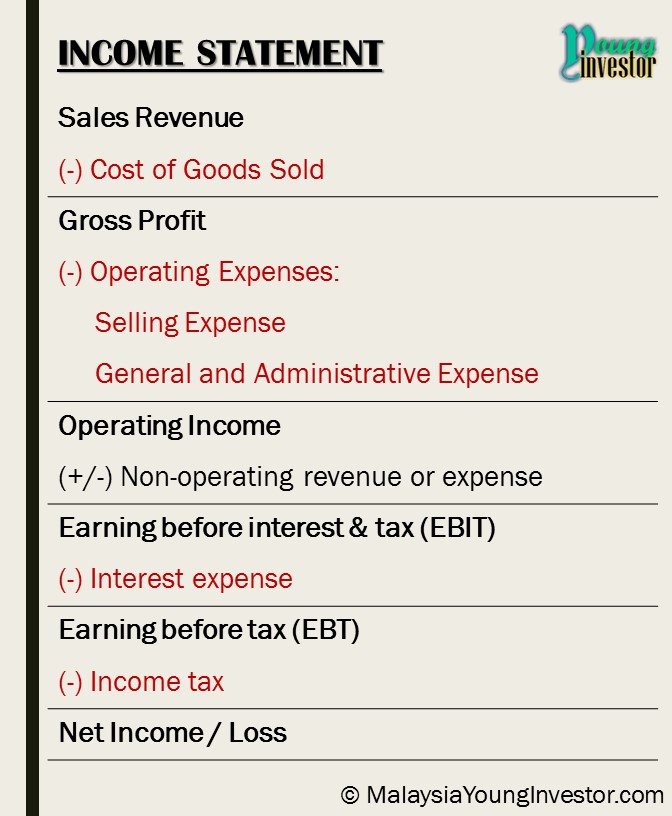

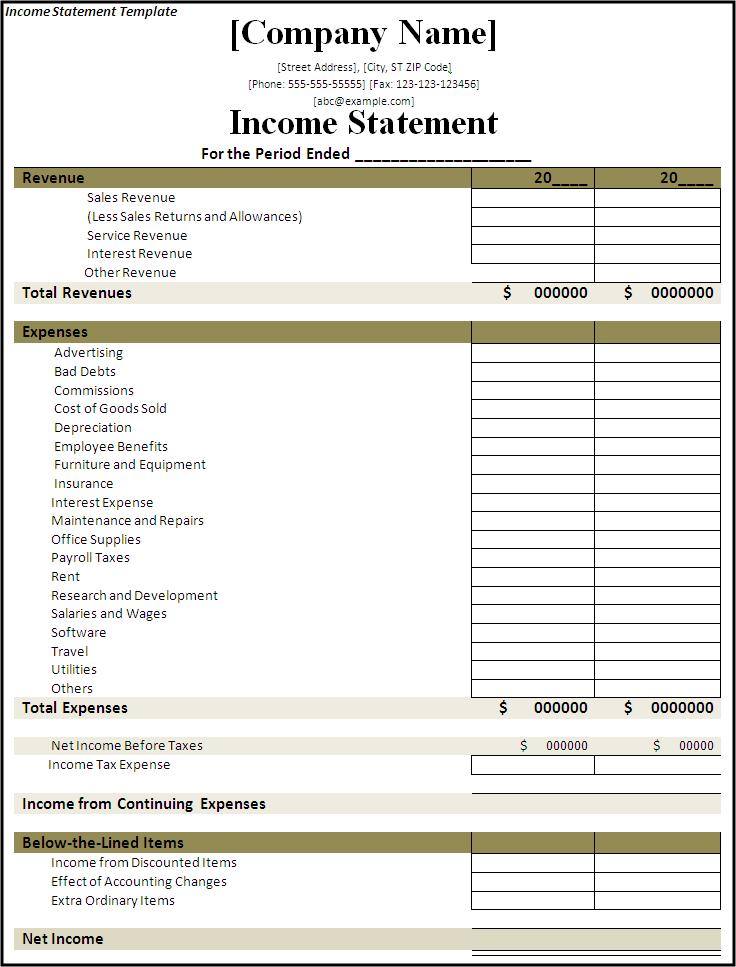

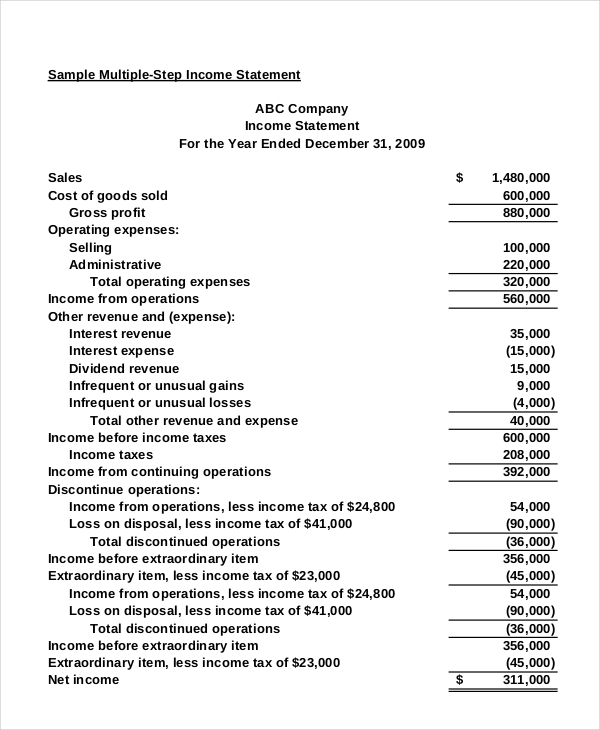

The income statement focuses on four key items:

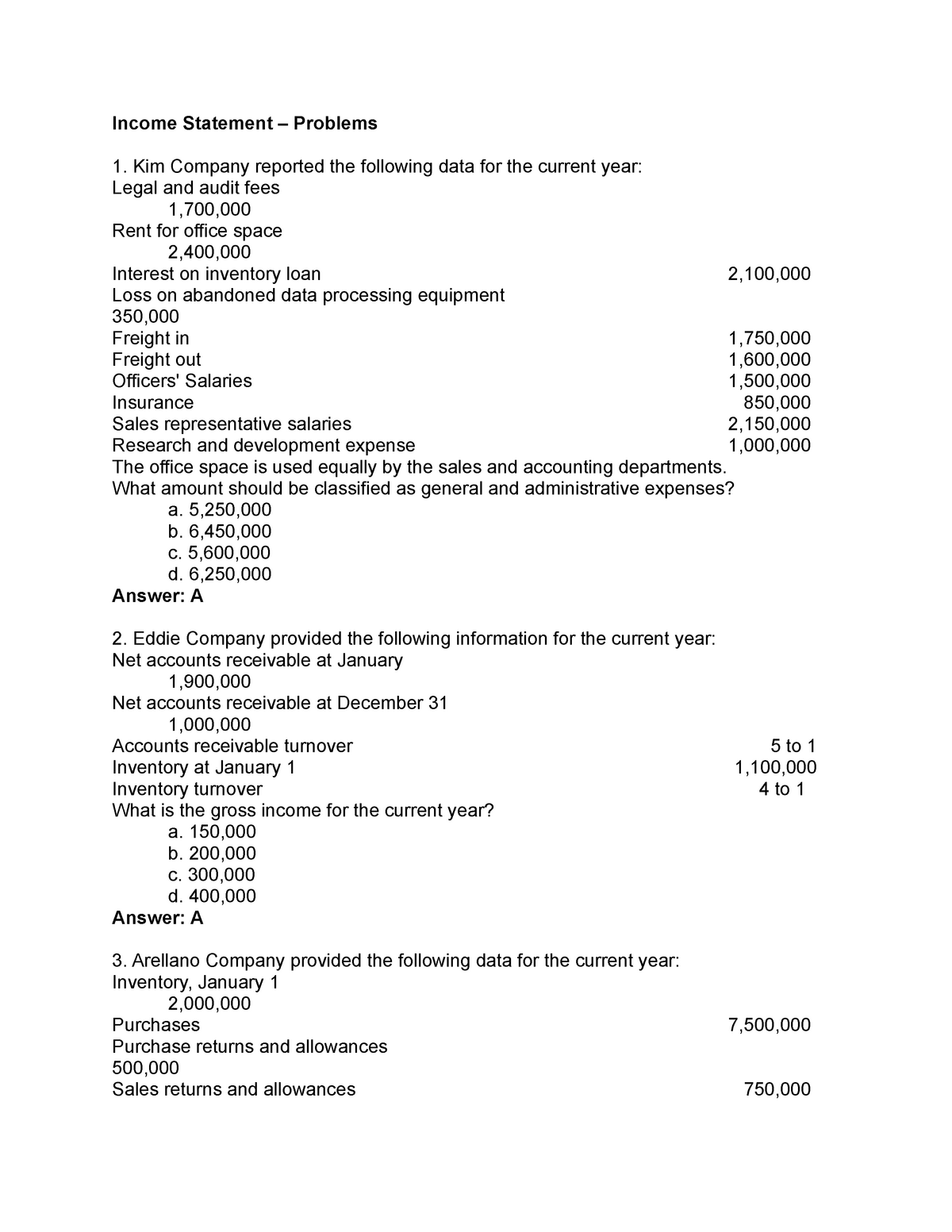

R&d on income statement. R&d capitalization is the process of classifying research and development activity as an asset rather than an expense. As an expense, they have a big impact on the bottom line and. Gaap, the majority of research and development costs (r&d) must be expensed in the current period due to the uncertainty surrounding any future economic benefit.

This article explains the accounting treatment for research and development (r&d) costs under both uk and international accounting standards. Accounting for r&d on the income statement? The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

The numerator, or gross profit, is normally located on the current year's income statement. While prior research consistently demonstrated benefits of “as. R&d expenditures cannot be reliably matched to future economic benefits that may or may not derive from them due to their uncertain nature.

Research & development (r&d) on the income statement perfect stock alert 35.6k subscribers 24 8.5k views 10 years ago income statement a video tutorial. Discretionary r&d capitalization under ifrs in germany authors: Next, the financing expenses subtract from the operating.

R&d costs are defined in asc 730. Trump a crushing defeat in his civil fraud case, finding the former president. A new york judge on friday handed donald j.

The accounting for treatment for r&d costs can materially impact a company's income statement and balance sheet. 16, 2024 updated 7:25 p.m. Our findings lend support to the proposition by barker and penman (2020) that deficiencies of the balance sheet that result from the uncertainty inherent in.

R&d expenses are included within the overall operating expenses and typically reflected as an individual line item on an income statement. There are also some accounting standards related to booking. The process to arrive at net income or earnings is to subtract the operating expenses from the revenues;

The r&d costs are included in the company’s operating expenses and are usually reflected in its income statement. Discretionary r&d capitalization under ifrs in germany journal of. Research and development ( r&d) expenses are associated directly with the research and development of a company's goods or services and any intellectual.

So, is the research and development (r&d) expense capitalized or expensed on the income statement? Sometimes companies choose not to explicitly state gross profit on. The profit or loss is determined by taking all.

They are listed on the income. Accounting for r&d on the income statement? Research and development (r&d) costs are the costs you incur for activities intended to develop or improve a product or service.

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)