Real Tips About Cash And Equivalents On Balance Sheet

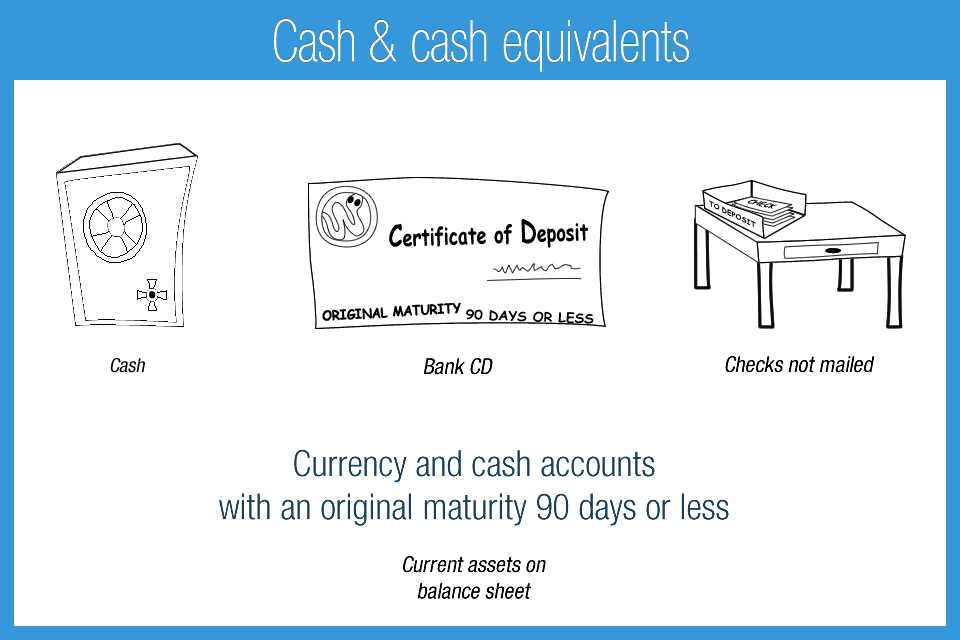

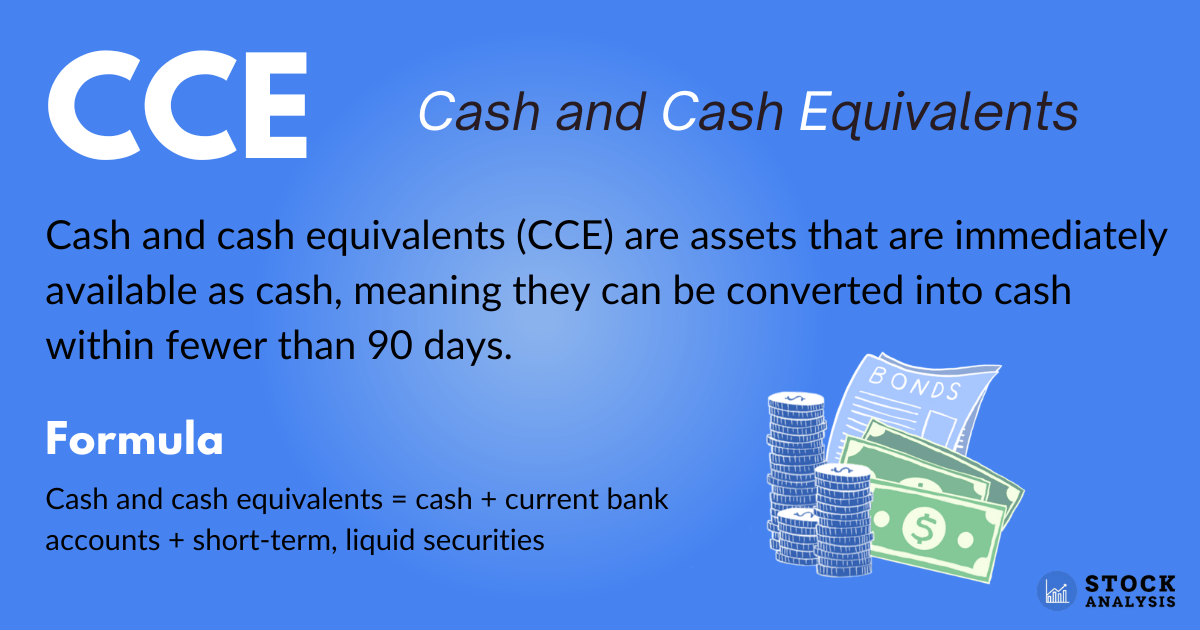

Cash and cash equivalents (cce) are company assets in cash form or in a form that can be easily converted to cash.

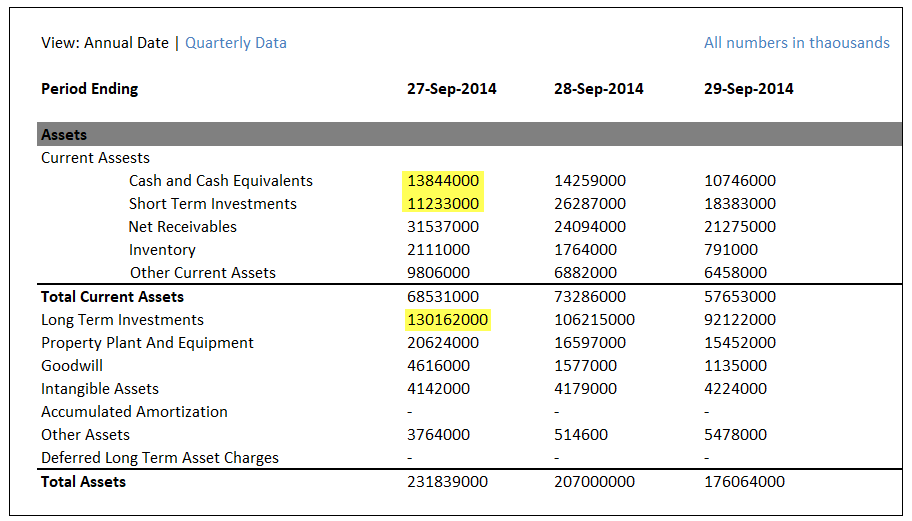

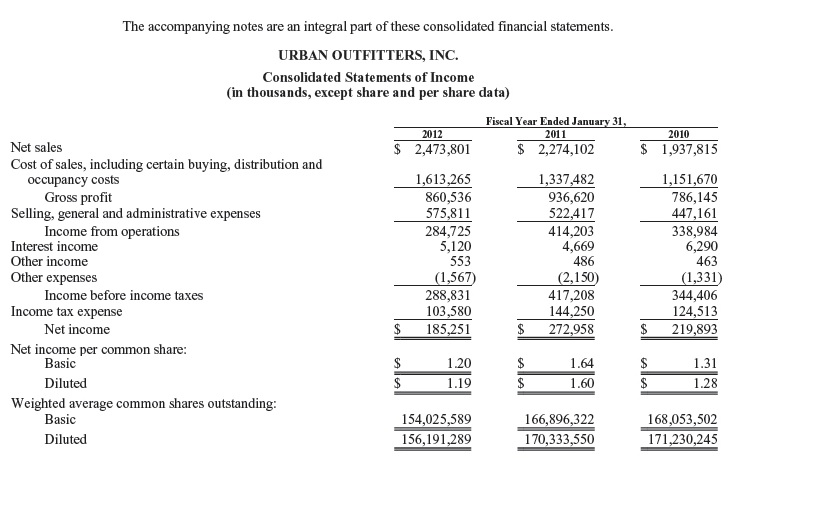

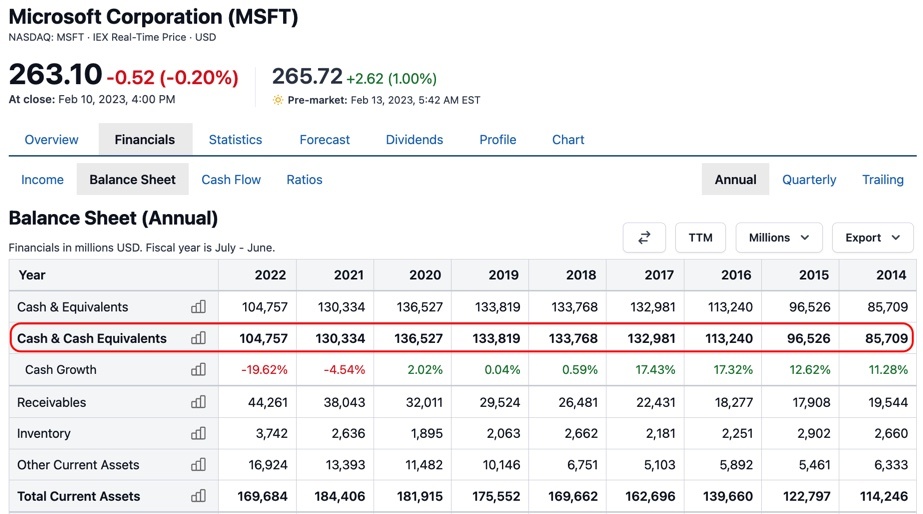

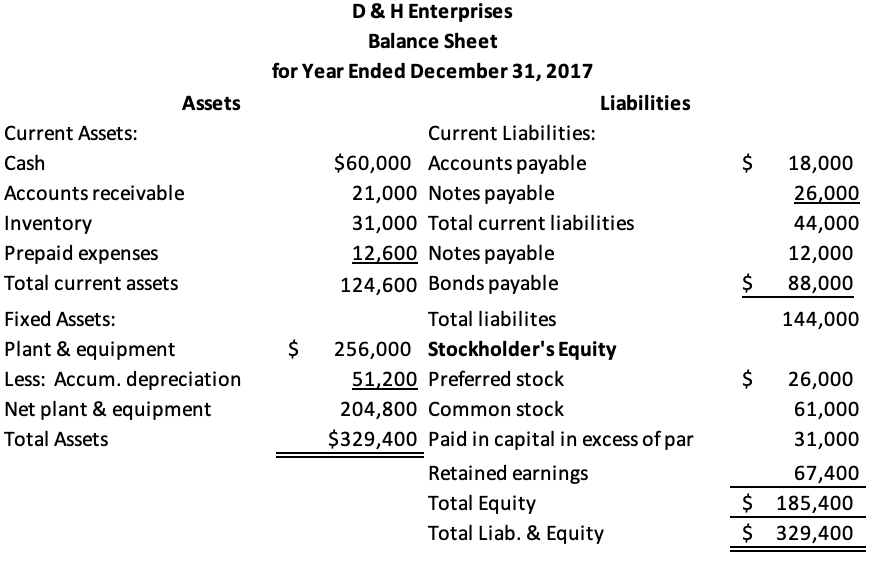

Cash and cash equivalents on balance sheet. Cash and cash equivalents are part of the current assets section of the balance sheet and contribute to a company’s net working capital. These assets are used in day to day operations of the business, and therefore, they are regarded as one of. Cash equivalents can be reported at their fair value, together with cash on the balance sheet.

As a practical matter, efficient financial management results in a very low cash balance because any excess funds are invested in cash equivalents. The financial statements are used by investors,. Cash equivalents are one of three main asset classes in.

Cash and cash equivalents can be combined on the balance sheet or reported as separate items. Fair value will be their cost at acquisition plus accrued interest to the date of the balance sheet. Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a company's assets that are cash or can be converted into cash immediately.

Cash and cash equivalents ( cce) are the most liquid current assets found on a business's balance sheet. Cash refers to money in. Cash and cash equivalent is represented in the balance sheet under current assets.

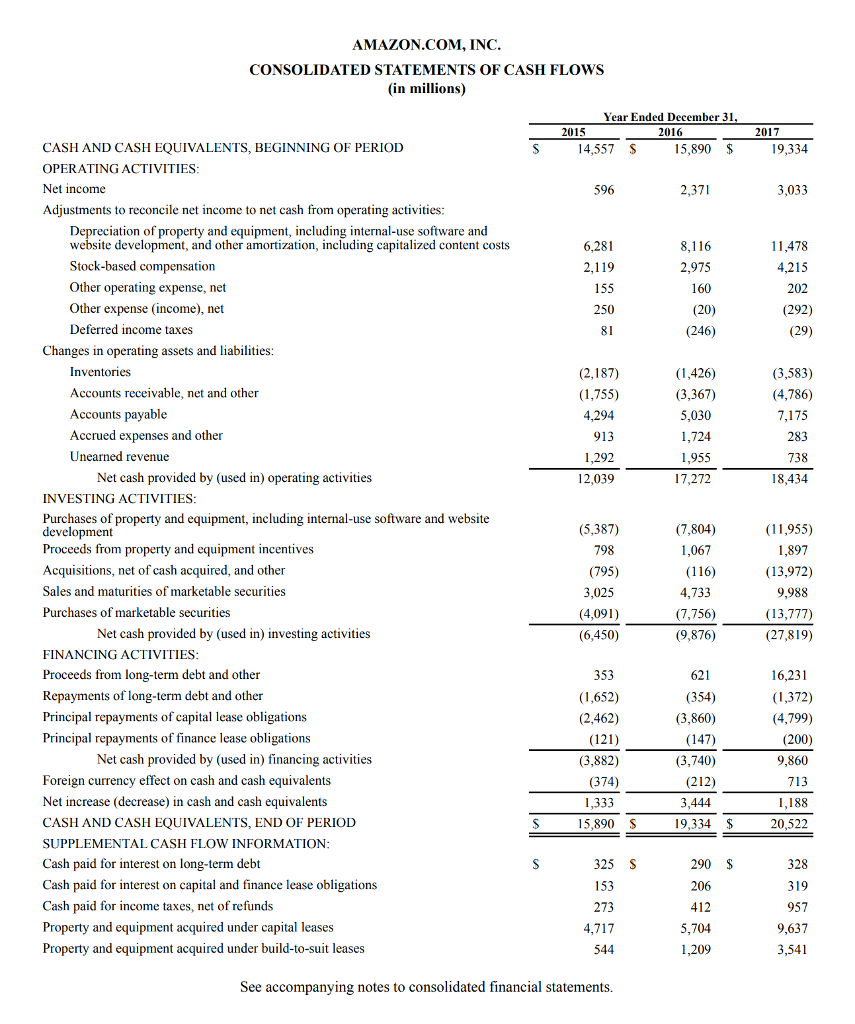

In the statement of cash flows, cash and cash equivalents also include bank overdrafts, which are recorded under current liabilities on the balance sheet. Fair value will be their cost at acquisition plus accrued interest to the date of the balance sheet. Cash and cash equivalents are reported in the balance sheet showing the total balance at the reporting with a comparative figure of the previous reporting balance.

Net working capital is equal to current assets, less current liabilities. In general, it is reporting the total in the current assets section of total assets. Below is a partial balance sheet from orange inc.

This is because they are readily usable. Commercial paper typically, the combined amount of cash and cash equivalents will be reported on the balance sheet as the first item in the section with the heading current assets. Businesses can report these two categories of assets on the balance sheet separately or together, but most companies choose to report them together.

Cash and cash equivalents (cce) are assets that are immediately available as cash, meaning they can be converted into cash within fewer than 90 days. To strengthen balance sheet, reduce debt and improve liquiditycompany also announces plans for strategic restructuring to drive annualized cost. Cash proceeds from sale enable buzzfeed, inc.

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. Cash and cash equivalents is an asset that appears on the statement of financial position of a business and includes currency (coins and banknotes) held by a business (in hand and in bank accounts) and cash equivalents. Identify cash and cash equivalents:

That shows cash and cash equivalents as at december 31, 2020 along with the corresponding notes: Cash and cash equivalents is a line item on the balance sheet , stating the amount of all cash or other assets that are readily convertible into cash. Examples of cash & cash eqiuvalents (cce) the balance sheet shows the amount of cash and cash equivalents at a given point in time, and the cash flow statement explains the change in cash and cash equivalents.

:max_bytes(150000):strip_icc()/CCE-009ecb73dfd94702821efed1264573af.jpg)